Everything you need to know about the W-8BEN form.

Tour overview

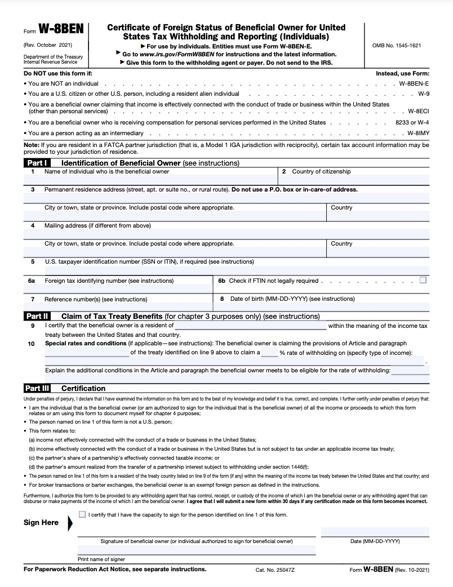

What is the W-8BEN form?

The Form W-8BEN, also known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting, is a tax document utilized by individuals and business entities who are not citizens of the United States. Its purpose is to confirm their country of residence for tax-related matters.

Who needs to submit the form?

If you fall into any of the following categories, it is mandatory to submit the W-8BEN form:

- If you are an individual.

- If you work as an independent contractor.

- If you operate as a sole proprietor.

What is the visual appearance or layout of Form W-8BEN?

Here is a link to the official form from the IRS.

Complete the W-8BEN form

To comply with the necessary regulations, Contractors are required to fill out the W-8BEN form. The form may take a few minutes to load.

Please be aware that once you have signed the form, it takes approximately 30 seconds for the e-sign system to process the signature. We suggest refreshing the page and waiting for the status to indicate "done."